How NoCode Tools Like Bubble Are Transforming Peer-to-Peer Payment Platforms

Published on December 19, 2024

By Valerie Rosemberg · 9 minute read

The Rise of Peer-to-Peer Transactions

In recent years, peer-to-peer transactions have fundamentally changed the way we handle personal money transfers. The advent of online payment methods has made it incredibly simple to send and receive money instantly, whether you’re splitting a dinner bill with friends or paying for a second-hand item. According to a recent report, the global peer-to-peer payment market is projected to grow by 18% by 2029, with a compound annual growth rate (CAGR) of 17.3% from 2021 to 2030. This impressive growth is largely driven by the increasing adoption of online payment methods, such as mobile wallets and digital payment apps. These platforms offer a level of convenience and speed that traditional banking methods simply can’t match, making them an attractive option for users worldwide.

The Growing Demand for Secure Online Payment Methods

As more users transition to online payments, the demand for secure payment systems has skyrocketed. Digital wallets, bank-linked accounts, and peer-to-peer payment platforms offer seamless transactions but also raise concerns about online payment security. Fraud prevention tools and two-factor authentication are now essential features to protect sensitive information, such as credit card data and linked bank accounts, from phishing attempts and data breaches.

Revolutionizing Peer-to-Peer Payments with Bubble: The Pay Ewe Journey

In a world where online scams and fraud are increasingly common, ensuring online payment security and secure transactions is more critical than ever. Kreante Agency, leveraging the power of NoCode, has developed a groundbreaking solution called Pay Ewe—a platform designed to offer peace of mind in peer-to-peer transactions. This blog explores how Kreante used Bubble, a leading NoCode platform, to bring Pay Ewe to life, transforming it from concept to reality in just a few months.

The NoCode Advantage in Building Pay Ewe

Why Choose Bubble for Secure Online Payment Methods?

When David Freeman and his team at Pay Ewe set out to create a secure, user-friendly platform for private transactions, they turned to Bubble for its versatility and ease of use. Ensuring the secure handling of credit card data was a top priority for the team. With no prior development experience, the team found Bubble’s NoCode capabilities to be an ideal solution for quickly bringing their vision to life. The platform allowed them to build complex, secure applications without the need for extensive coding, which was crucial given their limited resources.

From Idea to Implementation: The Development Process

Starting with a template and working closely with Kreante, the Pay Ewe team was able to adapt the platform to their specific needs. Over the course of three months, the initial concept evolved into a fully functional application that supports secure transactions for items like cars, furniture, and more on platforms like Facebook Marketplace and Gumtree.

The Unique Value Proposition of Pay Ewe

Solving Real-World Problems with Secure Transactions

Pay Ewe addresses a significant gap in the market by providing a secure, escrow-based payment system that ensures secure payments and protects both buyers and sellers. In a world where online transactions often involve long distances and unfamiliar parties, Pay Ewe ensures that funds are securely held until both parties are satisfied with the transaction.

Features that Set Pay Ewe Apart

Escrow Security: Funds are held in an independent bank account until the transaction is complete, offering peace of mind to both buyers and sellers. Users can also manage their funds using their Cash App balance, providing additional flexibility and convenience.

Low Fees: Transactions incur a minimal fee of just 0.89%, making it an affordable option for secure transactions.

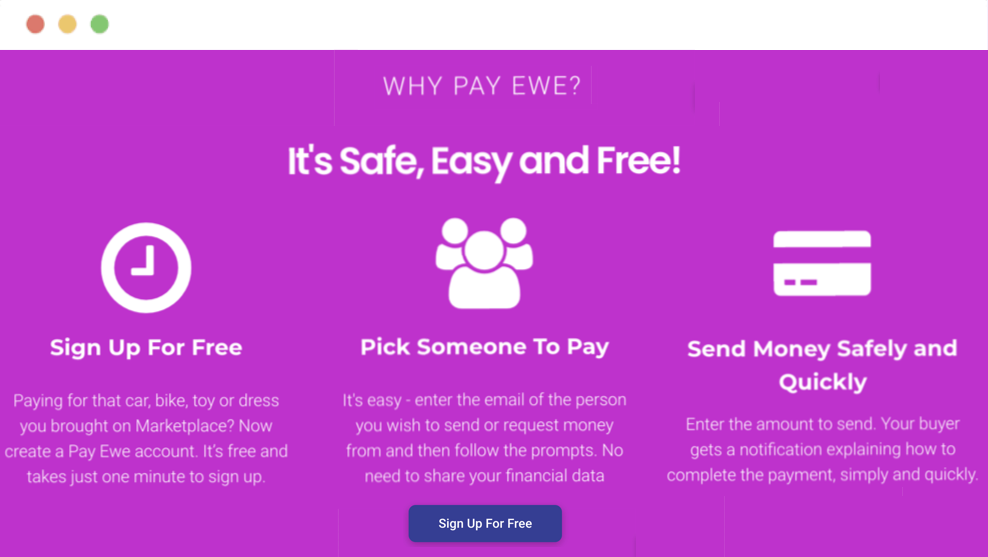

Quick and Easy Sign-Up: Creating a Pay Ewe account is free and takes just one minute, allowing users to start transacting securely in no time.

Instant Payment Release: Once the transaction is complete, funds are immediately released to the seller—no more waiting days for your money. Challenges and Triumphs: The Pay EweExperience

Challenges and Triumphs: The Pay Ewe Experience

Overcoming Development Hurdles

One of the biggest challenges the team faced was ensuring the platform could handle complex security protocols, such as integrating Connect ID for customer verification. Despite these challenges, Kreante successfully implemented the necessary features, proving Bubble’s flexibility and capability in handling even the most demanding requirements of a money transfer app.

The Importance of Security and Anti-Scam Features

In a market saturated with payment platforms, Pay Ewe differentiates itself by focusing on security and anti-scam measures. The platform's ability to verify both buyers and sellers, along with its escrow system, makes it a standout choice for users looking to avoid the pitfalls of online scams.

The Role of Online Payment Security in Today’s Market

Secure payment methods are no longer optional—they’re a necessity. Peer-to-peer payment platforms must implement robust security protocols, including encryption, two-factor authentication, and fraud prevention tools. The Pay Ewe team prioritized these elements to ensure a safe and trustworthy platform for users.

The Future of Peer-to-Peer Payments

Innovations on the Horizon

The peer-to-peer payment industry is constantly evolving. From instant deposits to low fees, platforms are competing to offer better transfer speeds and enhanced features. Future innovations may include AI-driven fraud detection, enhanced biometric authentication, and cross-border compatibility with lower conversion fees.

Expanding the Pay Ewe Ecosystem

With Pay Ewe now live and gaining traction, the team is focused on expanding its reach and continuing to enhance the platform's features. As they look to the future, Kreante's role in this journey remains pivotal. The collaboration between Kreante and Pay Ewe has not only resulted in a successful product but also laid the groundwork for future innovations in the peer-to-peer payment space.

The Future of Pay Ewe and Kreante's Role

With Pay Ewe now live and gaining traction, the team is focused on expanding its reach and continuing to enhance the platform's features. As they look to the future, Kreante's role in this journey remains pivotal. The collaboration between Kreante and Pay Ewe has not only resulted in a successful product but also laid the groundwork for future innovations in the peer-to-peer payment space.

Join the Revolution with Pay Ewe

Pay Ewe is more than just a payment platform; it's a movement towards safer, more secure online transactions. With the power of NoCode and the expertise of Kreante, Pay Ewe is poised to become a trusted name in the world of peer-to-peer payments.

Accelerating Software Development with Vibe Coding and AI Tools at Kreante

Kreante: Accelerating Your AppDevelopment with Low-Code, AI, and “Vibecoding”

.png)

.svg)